Pakistan’s exports to the United States, valued at nearly $6 billion, are now under a little bit of danger following US President Donald Trump’s latest reciprocal tariff adjustments on more than 180 countries.

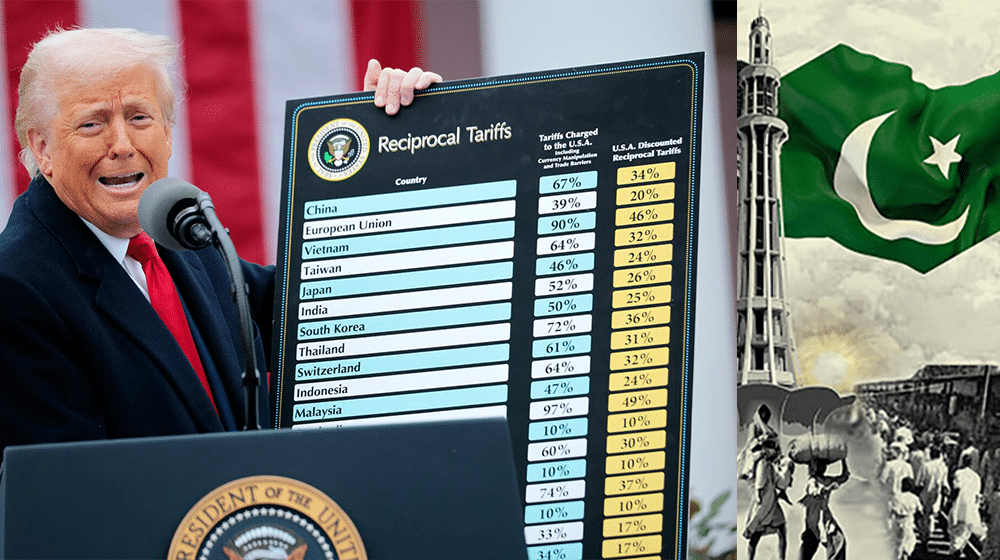

The new tariff rate has been raised to 29 percent on Pakistan, a big increase from the previous concessionary duties of around 4-5 percent that Pakistan enjoyed under the Generalized System of Preferences (GSP).

This sudden hike will make Pakistani exports considerably more expensive for American consumers, but Pakistan could take advantage of this change compared to its Asian peers.

Pakistan will have a cost advantage over Vietnam (46 percent), Indonesia (32 percent), Cambodia (49 percent), China (54 percent), and Bangladesh (37 percent) but will be at a disadvantage compared to India (26 percent), Turkey (10 percent), and Jordan, Egypt, and most Central American countries (23 percent).

The final impact will depend on how each country negotiates its terms, though a decline in sales to the US is expected regardless. Among the hardest-hit nations in Asia were Cambodia, where the rate stood at 49 percent, Vietnam at 47 percent, and Myanmar at 44 percent, the latter still reeling from a powerful earthquake.

Lesotho, a small southern African country, recorded the highest rate at 50 percent. The nation gained attention after former U.S. President Donald Trump once described it as a place “nobody has ever heard of.”

Textiles and clothing, which dominate Pakistan’s exports to the US, will be hit hardest. In 2023, Pakistan exported $5.01 billion worth of goods to the US, with textiles accounting for the bulk. Key export categories include miscellaneous textiles ($3.87 billion), knit or crochet clothing ($785.8 million), leather clothing and accessories ($591.8 million), and cotton-related products ($1.03 billion). With the 29% tariff increase, these products may struggle to remain competitive against lower-cost alternatives.

Luckily, peer competitors such as Vietnam, Bangladesh, and Sri Lanka face even higher tariff rates. This could provide Pakistan with a relative advantage if these countries struggle to meet demand due to expected rate hikes. However, Turkey and some Far Eastern nations may benefit from the disruption, depending on their capacity to fill the gap left in the American market.

So far, commentators on social media have claimed that calculations by Trump’s team are deeply flawed. Rather than being based on actual trade policies, the new rates appear to be derived from an arbitrary formula that divides the US trade deficit with a country by its total exports to the US. This approach has resulted in questionable figures, such as a claimed 64 percent Indonesian tariff rate—when no such rate exists. Also, the tariff structure shows that Pakistan charges a 58 percent tariff rate to the US, so Trump has levied a flat 29 percent duty on Pakistani imports to US docks.

“We will charge them approximately half of what they are and have been charging us,” Trump said in an announcement.

Additionally, the methodology fails to account for the US’s massive surplus in services trade, further distorting the justification for these tariffs.

As US import costs rise, consumers may seek alternative sources or switch to domestic products where possible. However, for essential goods with no direct substitutes, American buyers will likely face steep price increases. Pakistan’s textile industry, already under pressure from economic instability and energy costs, now faces an additional hurdle in retaining its position in the American market.

While Trump’s tariffs create challenges, they also open up new opportunities. With Bangladesh facing an even higher duty, Pakistan might still hold a competitive edge in some categories. However, much will depend on how quickly exporters adapt to the new tariff landscape.

Pakistan may seek a mega shift to supply routes like China and Iran to offset the impact of Trump’s reciprocal tariffs. More clarity will be offered in the weeks leading up to the federal budget 2025-26.

About the Author

Written by the expert legal team at Javid Law Associates. Our team specializes in corporate law, tax compliance, and business registration services across Pakistan.

Verified Professional

25+ Years Experience