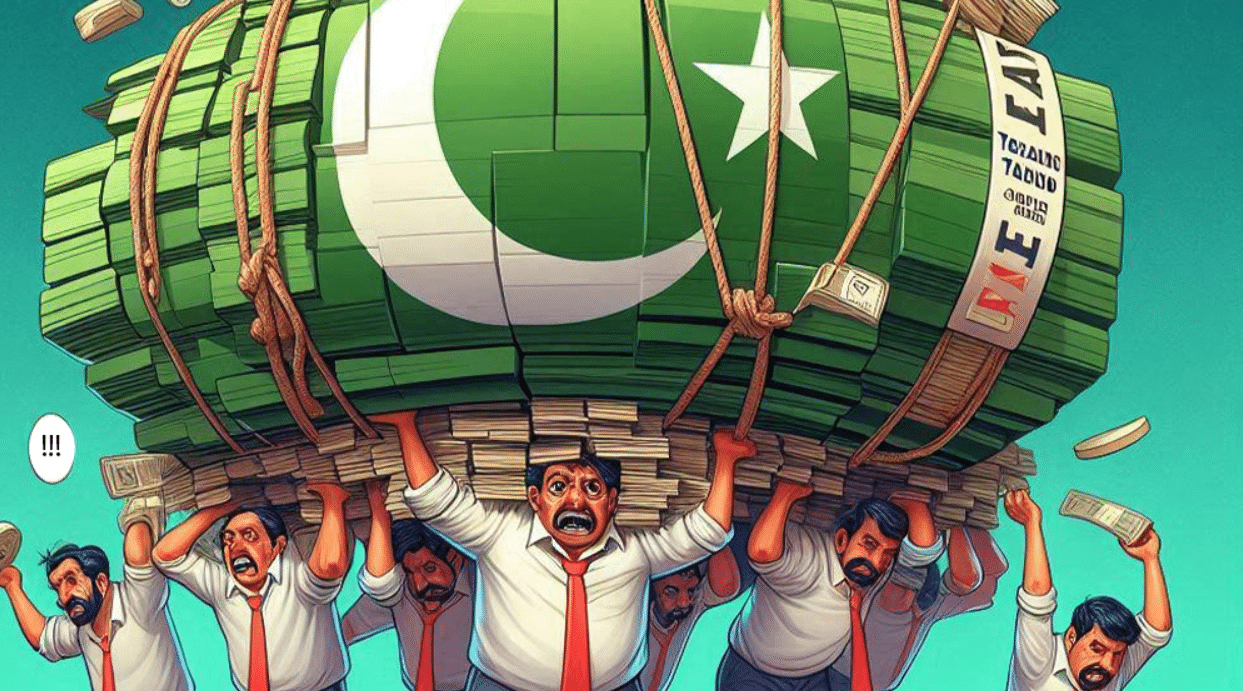

The salaried class paid Rs. 111 billion or 1,550 percent higher tax than traders during the first quarter of the current fiscal year, according to data from the Federal Board of Revenue (FBR).

This figure is Rs. 40 billion or 56 percent more than taxes collected from salaried individuals in the same period last year.

Traders paid just Rs. 6.7 billion in taxes despite the 150 percent higher withholding tax rates on goods supplied. This is also despite FBR’s new Tajir Dost scheme, under which registered retailers paid only Rs. 1.2 million tax by mid-October.

Private sector employees paid Rs. 83 billion in income tax at extortionate rates of around 39 percent. Meanwhile, government employees paid Rs. 28 billion in taxes.

The International Monetary Fund’s recent $7 billion loan agreement shows that the government has placed a big tax burden on salaried individuals as it plans to raise personal and corporate income tax yields by Rs. 357 billion this fiscal year.

About the Author

Written by the expert legal team at Javid Law Associates. Our team specializes in corporate law, tax compliance, and business registration services across Pakistan.

Verified Professional

25+ Years Experience